GENERAL SCOPE

Tax exemptions, exemptions and deductions play an important role in achieving the objectives of tax policies, such as promoting various sectors, ensuring social equality and increasing general welfare. Exemptions and exemptions allow certain organizations or activities to be fully or partially exempt from the tax burden. For example, certain institutions or organizations operating in fields such as education, healthcare, social services, science and technology often receive tax exemptions. Deductions, on the other hand, allow certain expenses or investments to be deducted from taxable income, thus reducing the tax burden. Investments such as R&D expenses, education and health expenses are generally subject to tax deduction.

EXEMPTION, EXCEPTION AND DISCOUNT AS A CONCEPT

1.1. Exemption

While the term exemption means exclusion and non-application, in the context of tax exemption; It refers to the situation where a real or legal person who meets certain conditions is not taxed or excluded from tax in a situation where he/she should be taxed according to tax laws. In tax exemptions, individuals or certain groups are excluded from tax liability and are not accepted as taxpayers (Işık, 2014: 162).

Exemption appears as a limitation on the taxpayer. For economic, social, political and technical reasons, some taxpayers are not taxed, that is, they are excluded from tax, even though they are related to the taxable event. This is a privilege that is brought for certain taxpayers and narrows the liability, and this privilege is called “exemption” (Şenyüz, Yüce and Gerçek, 2019: 91). Exemptions are seen as regulations applied to the taxpayer and eliminating the tax receivable (Bulutoğlu, 1982, p. 20).

1.2. Exceptional

While exception means keeping a situation or issue separate from similar ones, in the tax context, unlike exemption, it means that a certain issue or situation is not taxed by tax laws (Şenyüz, Yüce and Gerçek, Tax Law, 2019: 87).

An exception is a limitation on the tax subject, and a tax exemption is the non-taxation of an element, income or gain within the scope of taxation, according to the tax laws. Taxation of a subject is not carried out for a certain period of time or continuously due to economic, political or social reasons (Ersöz Kuru, 2019: 58). In summary, regulations that limit the subject of tax are called “exception”.

When the terms exemption and exception are examined from objective and subjective perspectives, it is seen that exemption is a subjective concept, that is, it is based on the taxpayer or tax subject. On the other hand, exemption is an objective concept based on the subject of the tax. Exemptions and exceptions; These are practices regulated by law to prevent certain people or subjects from being taxed for social, cultural, financial, economic and administrative reasons. In order for exemptions and exceptions to be applied, there must be a tax-paying ability to be taxed. This means that a taxable subject or person must exist. This subject or person must be excluded from tax by law (Akdoğan, 2019: 148-149). Simply put, when there is no taxable person or subject matter, there is no tax, and likewise, there are no exceptions or exemptions.

Exemption and exception practices are determined by law, and the underlying idea is that the benefit to be obtained as a result of not being taxed is greater than the benefit to be obtained as a result of the tax liability imposed on the person or subject (Capital, 2023: 8).

1.3. Discount

Tax deduction is defined as a tax advantage that helps reduce or limit the tax base. As an example of this situation, we can show wage earners to whom disability discount is applied. Tax deduction is a tax expenditure that makes it possible to deduct certain amounts from the gross income of taxpayers who meet certain qualifications by law. When calculating their taxable net income, taxpayers can deduct some items specified by law from their gross amounts as deductions (Dil, 2014: 6).

Tax deduction can generally be applied to people who meet certain conditions, for a certain period or continuously. These deductions serve a variety of policy goals, such as reducing the tax burden and encouraging certain economic activities or social conditions. For example, tax deductions given to companies investing in environmentally friendly technologies aim to encourage investment in such technologies (Ersöz Kuru, 2019: 58).

Tax deductions can be objective or subjective, such as exemptions and exemptions. Exemptions and deductions are generally based on the subject matter of the tax and are therefore considered objective. On the other hand, exemptions are generally based on the taxpayer and are therefore considered subjective. This shows that the application of tax deductions, exemptions and exemptions depends on both the subject of the tax and the taxpayer (Köse, 2009: 11).

USE OF EXEMPTIONS, EXCLUSIONS AND DISCOUNTS

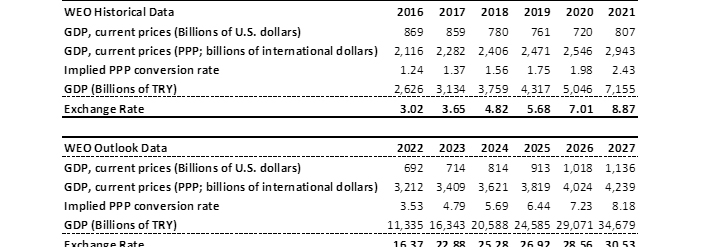

According to tax laws, some types of income or certain groups may be excluded from the taxation process in order to support certain economic and social goals. Exemptions, exceptions and deductions applied in accordance with the Income and Corporate Tax Laws in Turkey have led to the waiver of a significant amount of tax revenues that the state can receive (Association of Finance Accountants, 2019: 77). For example, the total amount of taxes given up by the state in 2017 was 68,851 million TL. This amount represents 37% of the corporate tax and 43.8% of the income tax that should be collected. While the expected tax expenditures in 2018 were 81,514 million TL, this figure increased to 96,298 million TL in 2019 (Ministry of Treasury and Finance, 2018: 284).

According to the data of the Ministry of Treasury and Finance, there is a constant increase in the tax revenues given up by the state due to tax exemptions, exemptions and discounts. This situation causes a significant decrease in the state’s total tax revenues and therefore a serious loss of income. This loss of revenue could limit the state’s ability to fund its services and strain its financial stability. Therefore, the social and economic benefits of tax reductions and exemptions must be carefully balanced with these potential revenue losses.

The returns on tax expenditures obtained through the application of exemptions, exclusions and discounts can be realized faster than the returns on general public expenditures. These tax expenditures are quickly rewarded and can have a rapid impact on various sectors of the economy. Particularly important incentives are provided to the activities of the private sector with tax advantages provided through exemptions, exclusions and discounts. These tax regulations increase the capacity of the private sector to invest and expand business activities and support economic growth. In addition, exemptions, exclusions and discounts can be used as a direct intervention tool in social and economic life. Through these tax regulations, goals such as promoting social justice, reducing poverty, or supporting certain industries or economic activities are attempted to be achieved (Küçük, 2013: 17).

In this way, exemptions, exclusions and discounts are both a tax policy tool capable of creating a rapid impact and provide the opportunity to create strategic effects on the economy and society towards specific targets. However, it is important that these regulations are carefully managed and effectively monitored and evaluated to achieve their intended effects.

The proliferation of exemptions, exceptions and deductions increases the complexity of tax laws and makes legal interpretations difficult. These tax regulations, which are implemented for social policy goals, are implemented for the purposes of ensuring tax justice and smoothing income distribution, but this process also causes the complexity of the tax legislation (Karabacak, 2013: 18-19).

This situation, which creates structural disorders and reduces the required tax efficiency, negatively affects the understandability and applicability of the tax system and creates uncertainty and complexity for taxpayers. This situation becomes more evident, especially if the number of exemptions and exemptions increases, and it directs taxpayers to change their income and activities, or even resort to tax avoidance, in order to benefit from tax advantages (Küçük, 2013: 22).

Exemptions, exceptions and discounts, also known as tax privileges, cover only certain subjects or taxpayers, affect consumption, investment and savings decisions and disrupt the effective and fair distribution of public resources. While these practices provide privileges to certain groups, they cause the state to give up the potential income it can obtain from taxable resources. This situation brings with it certain difficulties and limitations in terms of general tax policies and economic management (Küçük, 2013: 22).

The wide coverage of exemptions and exceptions in the laws and their excessive scope cause the state to suffer a great loss of income. The large number of these applications causes imbalance among taxpayers. While some taxpayers pay their taxes in full, others can partially or completely reduce their tax burden thanks to the privileges brought by these applications. This situation disrupts equality among all taxpayers, causing reactions and increasing tax resistance. In addition, too many exemptions and exclusions harm fair taxation, cause unfair competition and informal economy, and increase the state’s revenue loss (Uyanık, 2013: 22-23).

This situation, which creates structural disorders and reduces the required tax efficiency, negatively affects the understandability and applicability of the tax system and creates uncertainty and complexity for taxpayers. This situation becomes more evident, especially if the number of exemptions and exemptions increases, and it directs taxpayers to change their income and activities, or even resort to tax avoidance, in order to benefit from tax advantages (Küçük, 2013: 22).

Exemptions, exceptions and discounts, also known as tax privileges, cover only certain subjects or taxpayers, affect consumption, investment and savings decisions and disrupt the effective and fair distribution of public resources. While these practices provide privileges to certain groups, they cause the state to give up the potential income it can obtain from taxable resources. This situation brings with it certain difficulties and limitations in terms of general tax policies and economic management (Küçük, 2013: 22).

The wide coverage of exemptions and exceptions in the laws and their excessive scope cause the state to suffer a great loss of income. The large number of these applications causes imbalance among taxpayers. While some taxpayers pay their taxes in full, others can partially or completely reduce their tax burden thanks to the privileges brought by these applications. This situation disrupts equality among all taxpayers, causing reactions and increasing tax resistance. In addition, too many exemptions and exclusions harm fair taxation, cause unfair competition and informal economy, and increase the state’s revenue loss (Uyanık, 2013: 22-23).

EXEMPTIONS AND EXCEPTIONS IN THE INCOME TAX LAW

The Income Tax Law is a legislation that taxes earnings and income at certain rates. However, in this taxation process, there may be exemptions and exclusions for some earnings.

There are applications such as tradesman exemption, young entrepreneur exemption, exhibition and fair exemption for commercial earnings. In addition, there are tax exemptions for software, design and R&D activities, profits from industrial property rights and income from free zones (Köse, 2009: 11).

In terms of agricultural earnings, young farmer exemption and incentive bonus practices stand out. There are regulations such as exemptions for diplomats, servants working in embassies and consulates, meal fee and lodging exemptions in wage income. Applications for the self-employed include exhibition and fair exemption, young entrepreneur exemption, and certain exemptions for professions such as midwives and petitioners. In addition, tax exemption is provided for copyright and copyright earnings (Şenyüz, Yüce and Gerçek, 2019: 99-100).

There are regulations such as housing exemption for real estate capital income, dividend exemption for movable capital income, exemption for payments made from single-premium annual income insurance, and exemption for income paid to income sharing bonds (Şenyüz, Yüce and Gerçek, 2019: 99).

Finally, there is a transfer exemption for other earnings and revenues. All these exemptions and exemptions are used in certain cases to ease the tax burden and promote certain policies.

EXEMPTIONS AND EXCEPTIONS IN THE CORPORATE TAX LAW

The Corporate Tax Law contains various exemptions and exemptions. These exemptions cover some public administrations and organizations, local government enterprises, cooperatives, sports clubs, social security institutions established by law, institutions that provide credit guarantees, scientific research and development institutions and some businesses in special situations. For example, educational, cultural, artistic, health and social organizations, nurseries, guesthouses, military canteens and organizations that open exhibitions, fairs and fairs can benefit from these exemptions (Kavak, 2017: 401).

In addition, a number of exceptions are determined in the Corporate Tax Law. These include exemptions for participation gains, gains from the sale of subsidiary shares, real estate sales gains, investment fund and investment partnership gains, emission premiums and profits from overseas workplaces. In addition, earnings from overseas construction, repair, installation and technical services, earnings from schools and rehabilitation centers, and earnings from transfers or sales against bank debts are also exempt from tax (Şenyüz, Yüce and Gerçek, 2019: 210).

The law also includes regulations for special situations such as the risturn exception, industrial property rights exception, exception in sell-lease-repurchase transactions, foreign fund earnings exception, and exception for gains arising from the sale of assets and rights for the purpose of issuing lease certificates. These exemptions and exclusions were created to ease the tax burden of corporations in certain cases and to encourage certain policies. Therefore, understanding and applying these rules correctly enables institutions to make the most of the available incentives while fulfilling their tax obligations (Şenyüz, Yüce and Gerçek, 2019: 211).